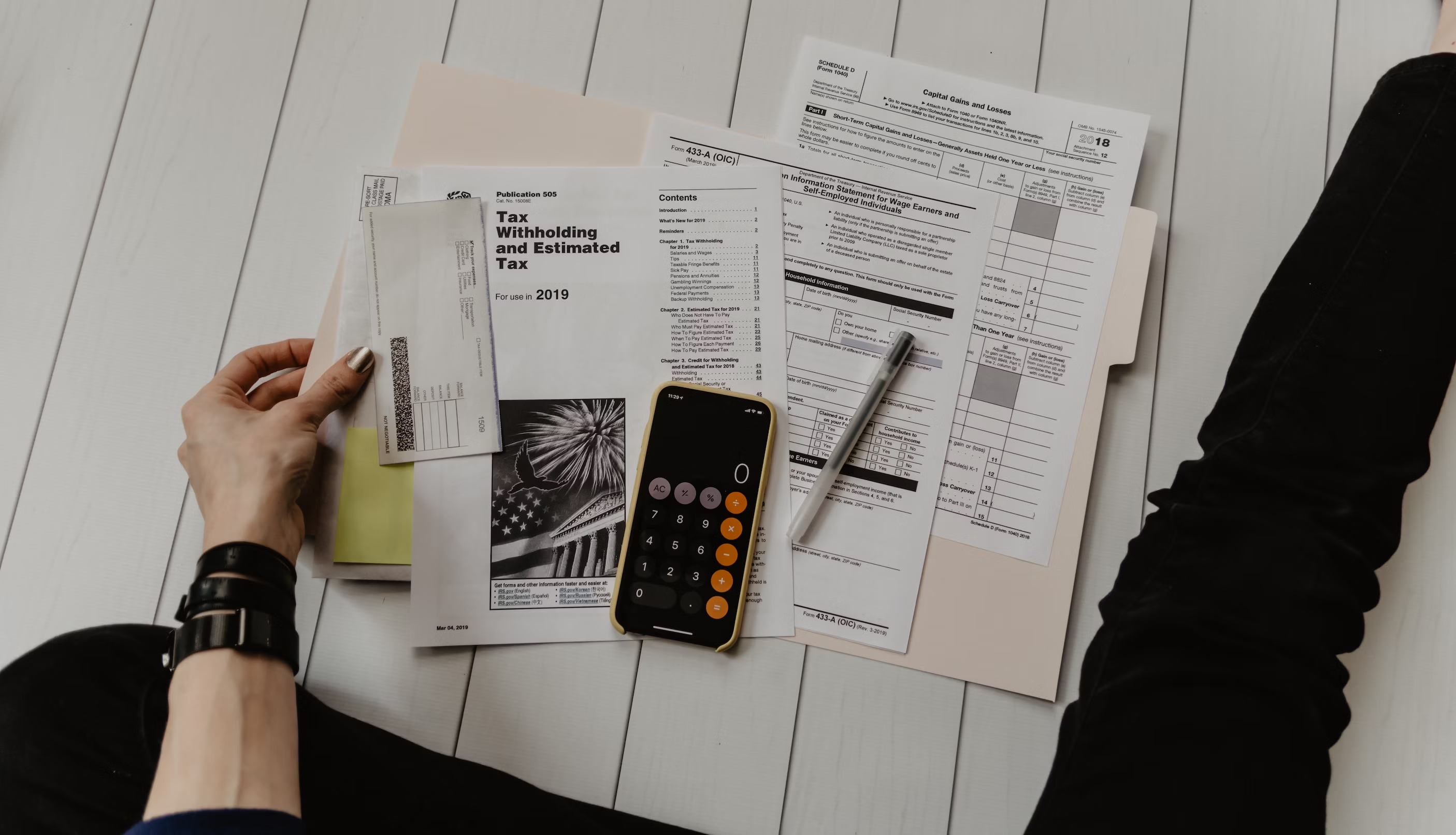

How does the Cost Segregation process work?

Submit your info

Send us your Closing statement or the Street address and purchase price. That's all we need to get started.

We send you free proposal

Within 24 hours, we send you back a free estimate of how much we can save you on taxes. Review the finding with your tax professional and we can move forward.

We visit to your property

We do a comprehensive walk-through. This will help us find you additional tax benefits. If you prefer we do a virtual visit through Facetime, we are set up to handle that as well. Our experienced cost segregation professionals have walked thousands of properties that allows us to leave no stone unturned.

We send you final report

After our walkthrough, we send you and your CPA a final report, which highlights the total depreciation expense for the property and include an itemized detail of each building component.

Reduce your taxes

What's the benefit to me?

Over 17 years, we have saved our clients over $2 Billion in taxes.

- Straight-line Depreciation.

- Most people use straight line depreciation. Which means they depreciate the value of their property by 27.5 years. If you have a $10M property, that results in ~$360k per year in depreciation.

- Cost Segregation.

- Instead, we itemize every part of your property. Roofs, Windows, Doors, etc. And apply a useful life (not just a broad 27.5 years) to each item. This results in a higher depreciation amount. As an example, we may increase that depreciation to $2.8M in year one. This results in a much larger tax defferal to you.

Most Real Estate property qualifies

Does my Property qualify for Cost Segregation?

Excluding your primary residence, most real estate that was placed into service after 1986 qualifies for Depreciation. Below are some of the most common types of Real Estate that qualify.

-

Multifamily

-

Self storage

-

Retail

-

Gas Stations

-

Office

-

Industrial Warehouses

-

Hotels / Motels

-

Short-term Rentals

-

Restaurants

-

Senior Housing

-

Car Wash

-

Golf Course

-

Mobile Home park

-

Fitness Center

-

Medical Office

Audit Proof

What's the catch?

No catch. The methodologies we use are both approved by and prescribed by the IRS in their audit techniques guide.

Cost Segregation is for anyone who wants to reduce their taxable income.

However, cost segregation likely shouldn't be used for people who are planning to sell their property within the next 12 months.

This is because of depreciation recapture. Cost segregation is a way to defer taxes, not fully eliminate them. When you sell your property, the depreciation you took in prior years, gets "added back" to the sales price. However, you can typically offset these gains by taking depreciation on another property or utilizing a 1031 exchange.

Our track record

Trusted by hundreds of clients for almost two decades

We pride ourselves on delivering high-quality work for clients.

- Taxes Deferred for Investors

- $2.3 Billion

- Cost Seg Studies Performed

- 2,000+

- Years in Business

- 17

- NPS Score from Clients

- 99/100

Happy Customers

We have delivered on our promises for hundreds of amazing people

"Had a great time connecting with Wes Mabry earlier this week and walking some of our properties. Terrific guy & knows his stuff. Highly Recommend for anyone looking for a cost seg study. If you think your stuff is too small, have him take a look anyway."

"Wes handles all of our cost segregation studies and is an absolute professional. Highly recommend using him for your properties!"

"Asked Wes for a 2nd opinion on cost segregation years ago and have been using him ever since. Works fast, detailed, and knows his stuff!"

"We use 1245 Consulting for all of our cost segregation studies on our properties. Saved us tens of thousands in taxes and charge a fair price."

Leadership Team

Our entire team consists of hard working Cost Segregation experts who are passionate about what we do and dedicated to delivering the best results for our clients.

-

Wes Mabry

Founding Partner

My entire career has been focused in the Cost Segregation business. I am a Certified Cost Segregation Professional which is the highest credential offered in the industry by the American Society of Cost Segregation Professionals (#C006-19). I've helped clients defer several billion in tax liability throughout my career. I pride myself on delivering high quality work for clients in a time-efficient manner.

-

Chris Hall

Managing Partner

I have over 18 years of experience in commercial and residential real estate and have performed thousands of cost segregation studies on virtually every type of real estate. I am also a Certified General Real Estate Appraiser (TX 1339849-G) experienced with best practice and industry-recognized real estate valuation methodologies.

Want to learn more?

Click below to send us an email, schedule a call, or get your free estimate!